Fiscal federalism in the United States of America

Keywords:

political constitution, tax system, tax principles, fiscal federalism, constitutional jurisprudence.Abstract

The author explains the functioning of the decentralized system of the United States of America and its legal bases in the concept of federalism. He emphasizes that the tax authority is one of the most formidable powers of government. Such power is shared among the Federal government, the states, and local communities, as described in the federal constitution and the constitutions of each state. The article begins with a general discussion of the tax authority, its nature, its purposes, and its use. This follows with an explanation of the legal bases of Federalism in the Federal Constitution and the jurisprudence of the federal courts. Later, the author exposes about the tax system of the Federal government and the legal bases for the distribution of the resources collected among the states. He ends with some general observations. These include observations on aspects of the system that have generated critical comment and observations on the factors responsible for the well-functioning of the US tax system.

References

American Trucking Association v. Sheine 483 US 266 (1987), Stevens, J., Supreme Court. Available: https://supreme.justia.com/cases/federal/us/483/266/

Complete Auto Transit v. Brady, 430 US 274 (1977). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/430/274/

Cotton Petroleum Corp v. New Mexico, 490 US 163 (1989), Stevens, J. USA Supreme Court. Available: https://supreme.justia.com/cases/federal/us/490/163/

Geier v. American Honda Motor Co., 529 US 861 (2000); Supreme Court. Available: https://supreme.justia.com/cases/federal/us/529/861/

Goldberg v. Sweet, 488 US 252 (1989), Marshall, J., Supreme Court. Available: https://supreme.justia.com/cases/federal/us/488/252/.

Granholm v. Heald, 544 US 460 (2005); Supreme Court. Available: https://supreme.justia.com/cases/federal/us/544/460/

Houck v. Little River Drainage, 239 US 254 (1915). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/239/254/

IRS (2020). Internal Revenue Service Progress Update, Fiscal Year 2020, Putting Taxpayers First. Available: https://www.irs.gov/pub/irs-prior/p5382--2020.pdf

IRS (2019)- IRS issues 2019 annual report; highlights program areas across the agency Available: https://www.irs.gov/newsroom/irs-issues-2019-annual-report-highlights-program-areas-across-the-agency

IRS (S/D). SOI Tax Stats - IRS Data Book Index of Tables, https://www.irs.gov/statistics/soi-tax-stats-irs-data-book-index-of-tables

KatzenBach v. McClung, 379 US 294 (1964). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/379/294/

Martin v. Hunter Lessee, 14 US (1 Wheat) 304 (1816). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/14/304/

McCulloch v. Maryland, 17 U.S. 316 (1819). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/17/316/

Minnesota v. Clover Leaf Creamery Co., 449 US 456 (1981), Supreme Court. Available: https://supreme.justia.com/cases/federal/us/449/456/

National Federation of Independent Business v. Sebelius (2012), 567 US__ (2012), Supreme Court. Available: https://supreme.justia.com/cases/federal/us/567/519/

New Jersey v. Anderson, 203 U.S. 403 (1906), Supreme Court. Available: https://supreme.justia.com/cases/federal/us/203/483/

Trinova Corp. v. Michigan Dept. of Transportation, 498 US 358 (1991), Kennedy, J.

United States v. Lopez, 514 US 549 (1995). Supreme Court. Available:

https://supreme.justia.com/cases/federal/us/514/549/

United States v. Darby, 312 U.S. 100 (1941). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/312/100/

United States v. Morrison, 529 US 598 (2000), Supreme Court. Available: https://supreme.justia.com/cases/federal/us/529/598/

West Lynn Creamery v. Healy, 512 US 186 (1994). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/512/186/

Wickard v. Filburn, 317 US111 (1942). Supreme Court. Available: https://supreme.justia.com/cases/federal/us/317/111/

Downloads

Published

How to Cite

License

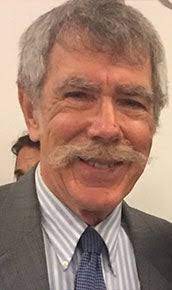

Copyright (c) 2023 William Berenson

This work is licensed under a Creative Commons Attribution 4.0 International License.